Related to the following themes:

Understanding the Differences Between Impact, Sustainability, and ESG

Recognizing the Interplay between Impact Management, Impact Utilization, and Corporate Value

Visualizing the Progression of Enhancing Corporate Value through Impact Utilization

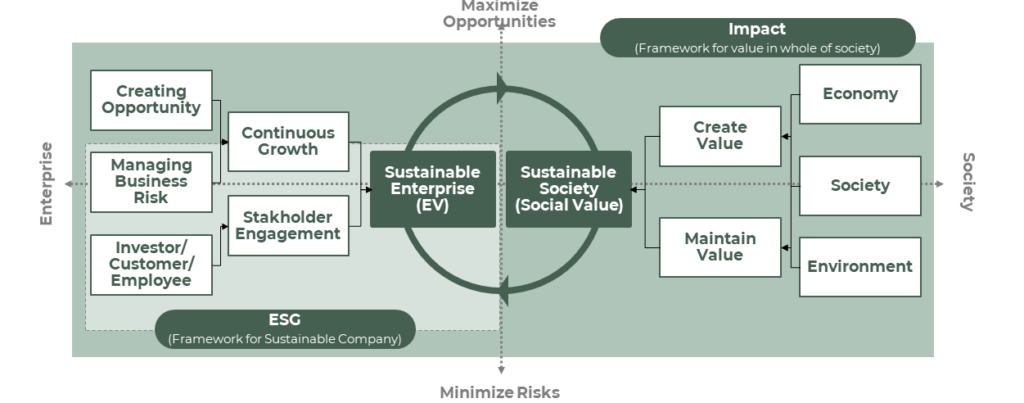

Definition of “Impact” and Its Relationship with “Sustainability” and “ESG”

At IMPACTLAKE, we define “ESG” as a framework that enhances and focuses on a company’s contributions to sustainability within the broader context. On the other hand, “Impact” goes beyond the scope of corporate value and strives to maximize societal value while also aiming to create business opportunities. Essentially, “Impact” encompasses a larger market target.

Recently, there has been a growing focus on concepts such as “Purpose-Driven Business” and “Creating Shared Value (CSV)” due to demands from institutional investors and the outstanding performance of companies engaged in these practices. These concepts operate within the framework of realizing sustainability management and a sustainable society, with “Purpose” representing the overall goal of how to achieve it. Furthermore, this achievement involves addressing specific management and societal issues essential to certain companies or industries, which we refer to as “Materiality”.

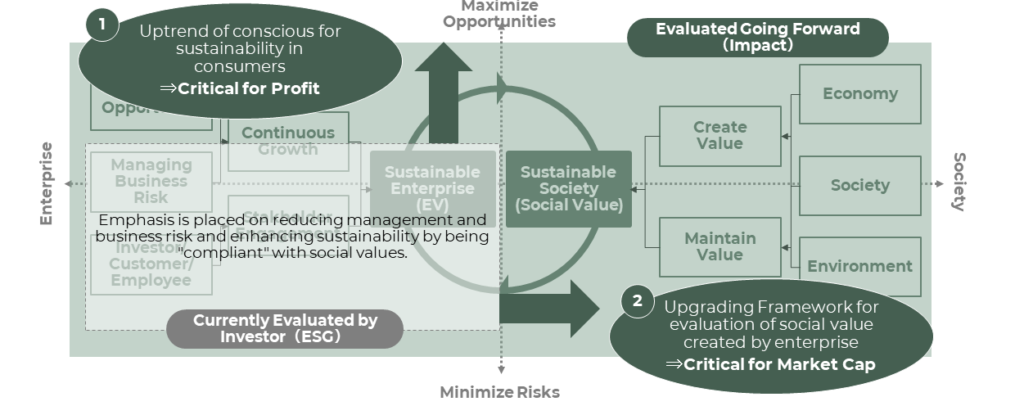

Why Does Impact Improve Corporate Value?

While ESG investments have gained prominence due to factors such as their ease of evaluation and the urgency of the issues involved, the importance of impact is rapidly increasing from two perspectives: 1) its influence on revenue and profit, and 2) its impact on corporate value. This has led to a growing demand for dialogues with stakeholders who are conscious of these two aspects.

Frameworks for evaluating corporate and business value, incorporating social value, have been steadily advancing. As a result, the impact on corporate value cannot be ignored. Moreover, with a growing understanding of and interest in sustainability in the market, encompassing consumers and the entire value chain, the impact as a business and revenue opportunity is expected to become increasingly significant.

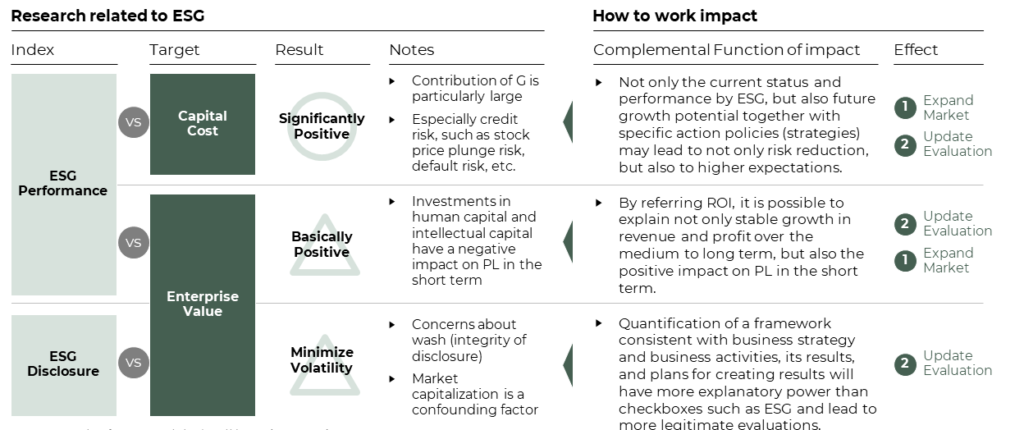

Impact on Corporate Value in Contrast to ESG

While there is currently limited analysis and research on impact investment, referencing various analyses on the existing “relationship between ESG and corporate value,” it can be said that impact may complement the enhancement of corporate value. ESG primarily has a positive effect on capital costs. However, its checkbox-like nature and difficulty in demonstrating alignment with financial performance, strategies, and business activities can potentially hinder corporate value evaluation. In this regard, impact may play a complementary (inclusive) role to ESG.

Steps to Enhance Corporate Value through Impact Utilization

Realizing the use of impact throughout the entire management process takes time, but it is crucial to proactively demonstrate your company’s stance. The era when ESG alone is not enough for evaluation is approaching, so it’s essential to use impact to showcase the progress of purpose-driven management externally.

Phase 1: Minimum Response to Investor and Stakeholder Perspectives

- Can investors and stakeholders envision the impact your company can create when they invest or provide other inputs?

- Moreover, are you collecting, scrutinizing, and disclosing information to the extent that investors and stakeholders can comprehend the expected effects and achievements?

Phase 2: Ensuring Alignment between Business Strategy and Impact Creation/Maximization

- Are you not only communicating about performance and direction but also explicitly outlining the strategies for maximizing the impact your company should or could create in the medium to long term?

- Consequently, is there alignment between your declared business strategy, improved performance, and impact creation, leading to the maximization of corporate value?

- How effective and practical are these strategies?

Phase 3: Consistency in Stakeholder and Company-Wide Direction

- In addition to demonstrating the company’s direction as a strategy, have you managed to integrate these directions into the organization’s overall policies and behavioral standards, from top to bottom?

- Do different departments genuinely digest and interpret these policies, using them organically as decision criteria and judgment frameworks?

- Moreover, do these policies get appropriately updated across short, medium, and long-term timeframes, ensuring a consistently harmonious set of activities?

- Are the human and social capital involved in these processes well-informed, motivated, and performing at an elevated level due to their understanding of the company’s impact strategy?

Exploring and Utilizing Impact Management

In the practical realm of impact management and impact accounting, publicly available information is still limited. IMPACTLAKE strives to systematically organize methodologies, case studies, and tips, making them as comprehensive as possible. We encourage you to make use of this information. Furthermore, for those considering the establishment of a structure and workflow to maximize the use of these resources and to continue creating value consistently, please don’t hesitate to contact us.

Additional Knowledge on Impact Management and Impact Accounting can be found here.

If you are considering utilization, please feel free to contact us.