Related to the following themes:

Understanding and Explaining the Importance of Impact Management in Business Operations.

Exploring Practical Applications and Specific Use Cases of Impact and Impact Management.

Recognizing Practical Challenges in Impact Management.

The importance of Impact Management

In recent years, corporate commitment to ESG (Environmental, Social, and Governance) practices has become a top priority for businesses seeking to create additional value and enhance their societal relevance. As the relationship between ESG and corporate value is being increasingly validated from multiple angles, the importance of impact, particularly from a positive perspective, is on the rise. It is expected to become a new common language in both internal and external corporate discussions.

Investments in intangible assets and ESG initiatives play a vital role in securing and enhancing a company’s profitability. This strategic approach contributes significantly to the creation of long-term corporate value.

METI Guidance for Collaborative Value Creation

Investments in human capital and intellectual property should be disclosed and provided in a clear and concrete manner, while considering their alignment with the company’s business strategy and management challenges.

The revised Corporate Governance Code

Our ambition is to create accounting statements that transparently capture external impacts in a way that drives investor and managerial decision making.

Impact-Weighted Accounts Project

We develop and test new methodologies to measure the value of corporate behavior and business models in real life – to translate environmental and social impacts into comparable financial data.

value balancing alliance

In this context, the need for expanded information disclosure and dialogue is increasing. However, the granularity and diversity of impact data can pose a significant challenge for stakeholders, including investors, in terms of evaluation and understanding. It is essential for companies to communicate the impacts they create as part of their management and business strategies, positioning them as a genuine corporate asset.

On the other hand, businesses are experiencing an increasing practical burden related to information disclosure. To foster the growth of sustainable and substantive dialogues in the future, it is crucial to advance both the sophistication of evaluation and dialogue frameworks and the efficiency of practical workloads from a long-term perspective.

Specific Uses of Impact

To maximize the effectiveness of managing and aligning the impacts an organization creates or can create with its business activities, the following actions are envisioned:

Internal Disclosure and Dialogue

Express the true appeal of your company, business, and investments quantitatively and qualitatively from the perspective of the impacts generated.

- Disclosure, Investor Relations, and Engagement

- Promotion

- Internal Branding

Impact Management

Establish an organizational framework with an impact-oriented approach to ensure the effective management of impacts.

- Impact Measurement for Specific Cases (e.g., Investments)

- Incorporating impact into business and talent assessments.

- Collecting Internal and External Data for Ongoing Evaluation

Participation in Various Strategic Formulations and Execution

Incorporating impact into decision-making, going beyond financial returns to make decisions with impact as a key element.

- Long-term Vision and Mid-term Business Plan Development

- Developing strategies for business, R&D, and new business creation, including aspects related to impact.

- Mergers and Acquisitions, Open Innovation, etc.

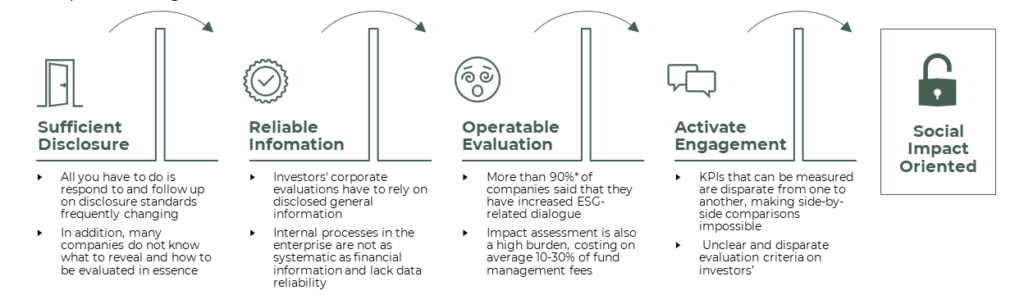

Issues in Qualitative and Quantitative Impact Management

On the other hand, when it comes to the proper evaluation and management of impact, there are still many challenges both quantitatively and qualitatively. This is due to the lack of established evaluation methods and the limited availability of usable information, which presents numerous challenges for both investors and companies.

Impact-Related Information Collection and Disclosure

- Coping with the constantly increasing and changing disclosure standards is already a handful.

- In addition, many companies are uncertain about what and how to disclose information that will be fundamentally valued.

- Investors are often forced to rely on disclosed information and general online data for evaluating companies.

- Internal processes within companies lack the level of structuring seen in financial data and often suffer from data reliability issues.

Impact Measurement, Management, and Dialogue

- When compared to five years ago, over 90% of companies reported an increased burden related to ESG.

- On the investor side, fund management fees are relatively high, averaging around 10-30%.

- Additionally, evaluations are often qualitative, and the framework for assessments varies, making cross-comparisons challenging.

- Analog and one-way dialogues predominate, hindering substantive discussions.

Impact Management Achieved with impactlake™

impactlake™ serves as an impact management tool that addresses the qualitative and quantitative challenges mentioned above. It provides the necessary features and information for impact assessment and management, aiming to promote an impact perspective and orientation among investors and companies.

Key Functions

- Impact Model (Logic Model) Construction Wizard

- Impact Quantification

- Impact Management Dashboard

- Impact Web Disclosure

- Sector-Specific Standard Impact Model (Logic Model)

- Impact Accounting

- Simplified Impact Report Generation

- Impact Portfolio and Departmental Management

- Impact Planning and Budget Management

The benefits of impactlake™ include:

Efficiency in Workload Management

- To ensure the continuous implementation of impact assessment activities beyond the first year, efforts are made to reduce the immediate operational burdens that may arise.

- Additionally, instead of relying solely on external resources, internal management is encouraged to foster an internal understanding and recognition of impact, thus promoting a cultural shift within the organization.

- Simultaneously, involving stakeholders in the process and streamlining the workload enables a more focused and substantial dialogue with stakeholders.

Enhanced Framework for Evaluation and Dialogue

- By utilizing standardized and generalized frameworks and simultaneously reducing evaluation costs, it becomes possible to expand the scope of evaluation in a nonlinear fashion.

- As a result, the contribution to impact as investors can be visualized, extending beyond the assessment of individual cases.

- Furthermore, such endeavors facilitate the maximization of returns to stakeholders through the impact of investment and business activities, as well as subsequent business growth and corporate value enhancement.

Exploring and Utilizing Impact Management

In the practical realm of impact management and impact accounting, publicly available information is still limited. IMPACTLAKE strives to systematically organize methodologies, case studies, and tips, making them as comprehensive as possible. We encourage you to make use of this information. Furthermore, for those considering the establishment of a structure and workflow to maximize the use of these resources and to continue creating value consistently, please don’t hesitate to contact us.

Additional Knowledge on Impact Management and Impact Accounting can be found here.

If you are considering utilization, please feel free to contact us.