Related to the following themes:

Reaffirming the Growing Importance of Impact Management in Impact and Responsible Investment.

Understanding the Practical Challenges of Impact Management for Investors (Both Institutional and Private).

Gaining Insights and Exploring the Concrete Implementation Methods and Steps for Impact Management.

The Importance and Utility of Impact for Investors

For financial institutions and investors to provide added value and enhance their societal relevance, commitment to ESG has become indispensable. With the multifaceted relationship between ESG and corporate value being increasingly demonstrated, the significance of impact, particularly as a positive facet, is on the rise. It is anticipated to become a new common language in the market.

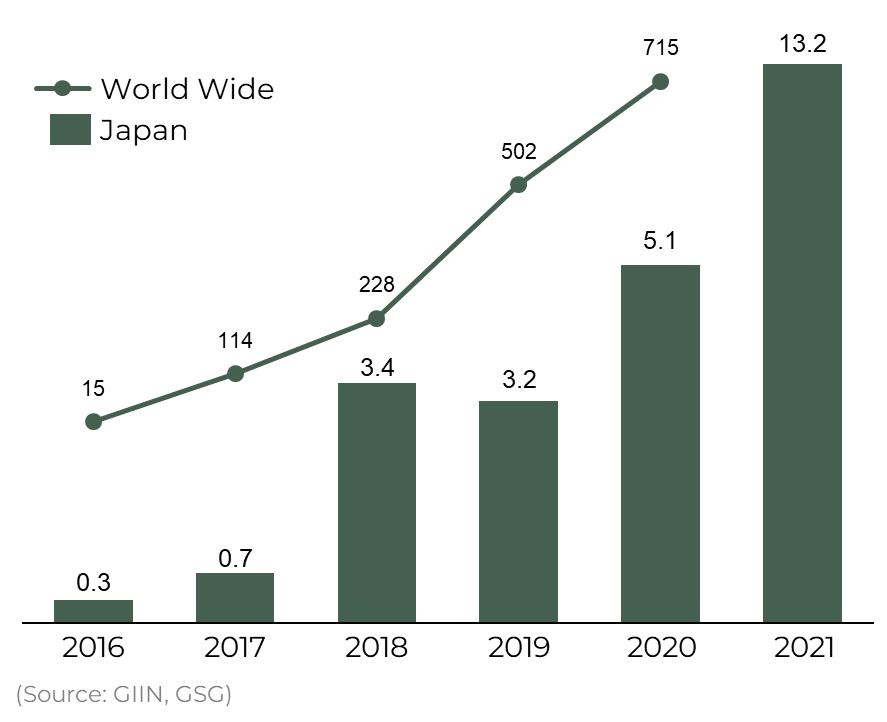

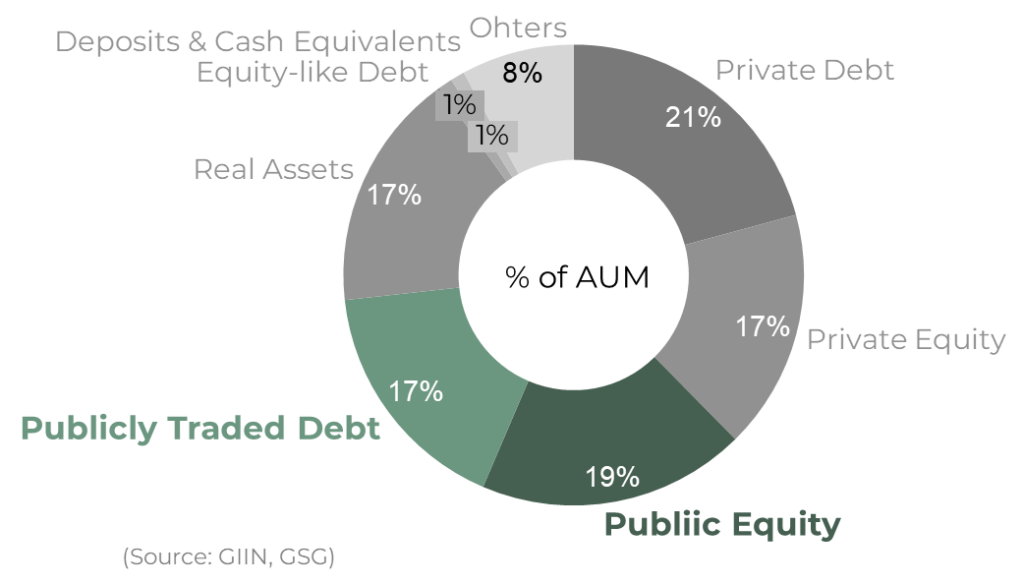

In this context, the impact investment market is expanding not only in terms of the amount and number of investments but also from the perspective of asset classes and investment methods. Notably, listed investment is on the rise, with investment balances expanding, and particularly in the domestic market, there is potential for future growth, given its immature nature.

Key Challenges in Impact for Investors

Within this context, the need for expanded information disclosure and dialogue becomes increasingly important. Impact, however, is often characterized by a finer granularity and a greater diversity, making it more challenging to assess and quantify compared to ESG and similar factors. Furthermore, the intention of the input side (investing and lending) is highly emphasized, which calls for an even greater need for knowledge, information, and communication.

These factors contribute to an increase in practical burdens, and to facilitate the widespread adoption of sustainable and meaningful dialogues in the future, it will be necessary to advance both the “sophistication of assessment and dialogue frameworks” and the “efficiency of practical burdens” over the medium to long term.

Impact assessment can come with costs ranging from an average of 10-30% of fund management fees.

GIIN Impact Invest Survey 2020

When KPI measurement aligned with the fund’s intention is not conducted, or when KPIs that can be measured vary significantly from one investment to another, making cross-comparisons difficult, it hinders investment decisions and the effective use of engagement.

Fund Manager at a Leading Asset Management Company in Japan

Features of impactlake™

In order to address these challenges, impactlake™ covers the entire process of impact assessment and management that investors require, streamlining and enhancing engagement with companies, as well as various reporting and disclosure activities. Additionally, we provide a flow not only for impact management in current impact funds but also for managing a larger AUM as investors become more conscious of impact. We offer the following specific functions:

- Collection of Impact Information and Metrics for Investment Targets and Prospective Investments

- Impact Simulation for Virtual Portfolios

- Comparison of Impact with Other Companies and Portfolios

- Internal Issue Identification and Goal Integration

- Engagement Activities with Investment Targets

- Selection, Establishment, and Management of Key Performance Indicators (KPIs) (including deadlines, reporting content, etc.)

- Clarification of the Targeted Impact Model (Logic Model)

- Quantification of Impact Generated or Potentially Generated by Investments

- Creation and Presentation of External Reports (Impact Reports, etc.)

- Internal Management and Continuous Data Acquisition and Maintenance

Visualization of the Implementation Process

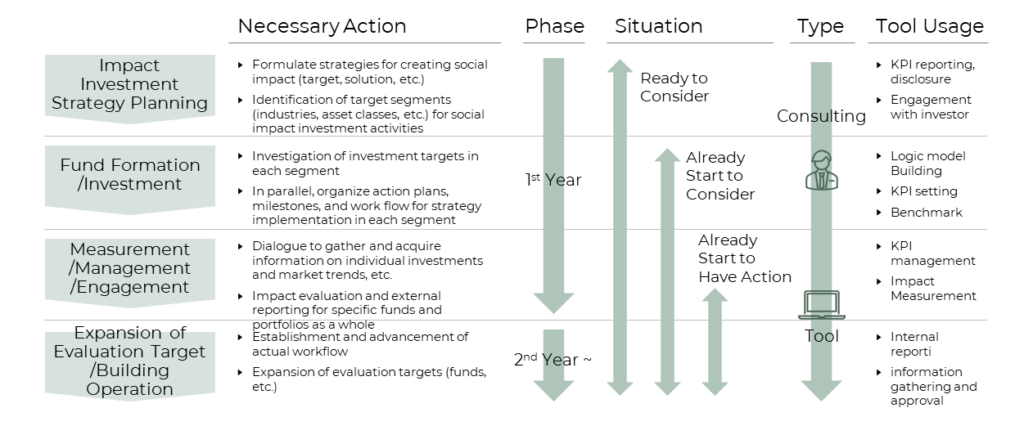

In reality, providing a tool alone does not necessarily achieve the desired outcomes. It’s important to consider how to make responsible investment activities effective and how they can contribute to the growth of AUM and improved returns. In other words, you need to examine what contributions your company can make to impact in its investment and lending activities, how to create impact through these activities, how to align them with the strategies of your investment targets through engagement, and how to continuously implement and expand these activities within your organization.

At IMPACTLAKE, we offer comprehensive and phased implementation, which can be complemented with consulting services, to help you address these aspects. We can work closely with you at every stage, whether it’s for in-house execution or outsourcing on an ad-hoc basis, to assist you in achieving your goals.

Exploring and Utilizing Impact Management

In the practical realm of impact management and impact accounting, publicly available information is still limited. IMPACTLAKE strives to systematically organize methodologies, case studies, and tips, making them as comprehensive as possible. We encourage you to make use of this information. Furthermore, for those considering the establishment of a structure and workflow to maximize the use of these resources and to continue creating value consistently, please don’t hesitate to contact us.

Additional Knowledge on Impact Management and Impact Accounting can be found here.

If you are considering utilization, please feel free to contact us.