Impact accounting is a framework used by companies to assess the impact they create by assigning it an economic value based on specific criteria. It integrates existing financial accounting with the quantification of both positive and negative impacts. It allows for the aggregation of quantified and economically valued impacts at the organizational, corporate, or portfolio levels, and even across different thematic areas.

Beyond quantification, continuous and quantitative impact management takes place under specific rules and standards. Impact accounting serves as a valuable source of information for stakeholders. It not only enhances transparency but also helps organizations reflect on their current achievements and future strategies. It brings to stakeholders’ attention the potential impacts that can be generated, thus increasing the likelihood of successful planning.

Common Methods of Impact Accounting

In the past, there have been efforts to quantify externalities created by companies and business activities and add or subtract their financial value. However, recently, two advanced and comprehensive approaches have gained attention as initiatives.

Impact Weighted Accounts

In 2019, the “Impact-Weighted Accounts” project was initiated at Harvard Business School (HBS). This project aims to convert various impacts of companies into monetary values and include them in financial statements, thereby creating impact-weighted financial statements.

Value Balancing Alliance

Established in August 2019, the Value Balancing Alliance is a nonprofit organization founded by eight global companies, including BASF, Bosch, Novartis, SAP, and others. It collaborates with organizations such as the OECD (Organisation for Economic Co-operation and Development), the European Commission, the “Big Four” auditing firms (Deloitte, EY, KPMG, PwC), and Harvard Business School. Its mission is to develop global impact measurement and valuation (IMV) standards to disclose the positive and negative impacts of corporate activities in monetary terms. The alliance also aims to provide guidance on how to integrate these impacts into business practices.

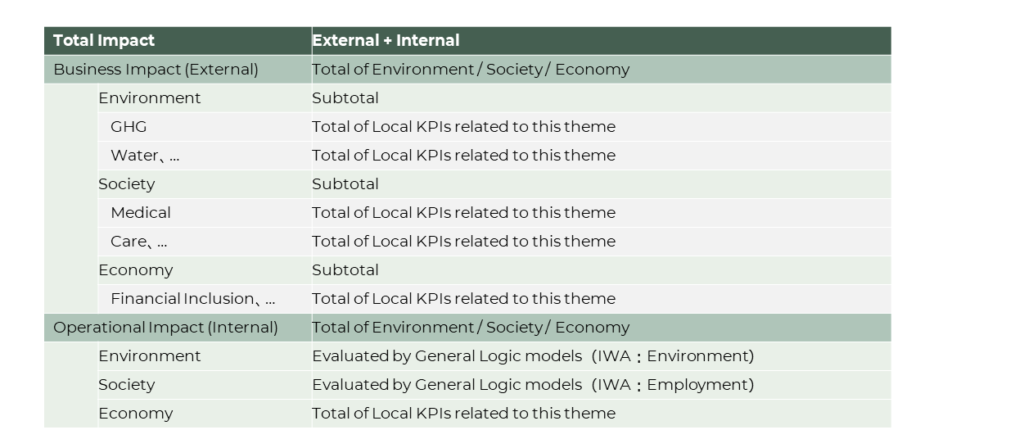

Impact Accounting at impactlake

At impactlake, we perform impact accounting based on the following categorization to quantify the impacts created by organizations and businesses. We classify them into two main categories: those resulting from business activities (primarily the impacts on external stakeholders) and those stemming from management activities (impacts not directly tied to core business operations, mainly from internal activities or CSR initiatives). We further break down these impacts into categories related to the environment, society, and the economy (for detailed categories, please refer here). For each of these impacts, we assess and measure whether they are positive or negative, and then aggregate them at the organizational or corporate level, which constitutes impact accounting.

While there will likely be stringent rules and standards established at a global level in the future for calculation and assessment, at present, we recommend setting specific criteria for the selection of inclusions and exclusions. Especially when dealing with negative impacts, having a framework that ensures thorough consideration of commonly recognized negative impacts (often defined in ESG, such as environmental impacts and unfair labor practices) will enable addressing concerns related to greenwashing and criticisms (refer here for impact recognition requirements).

Relationship with IWA

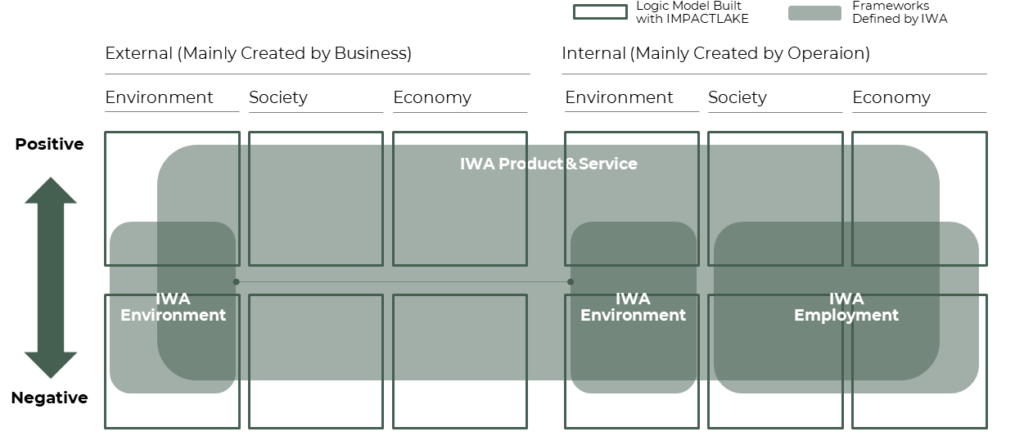

At impactlake, we adopt the Impact Model (Logic Model) as the fundamental form of impact management. This approach focuses on specific impacts (issue resolution) and top-down methodology to illustrate the required elements. On the other hand, IWA defines Impact Weighted Accounts, which concentrate on “specific activities (the primary activities that generate impact)” and follow a bottom-up approach to enumerate associated impacts. It’s important to note that we are not making value judgments about the superiority or inferiority of these methods.

As shown in Step 3, the Impact Model constructed at impactlake aims to align with IWA’s framework by ensuring the comprehensiveness of the Output layer. While the approaches may differ, organizations and businesses can integrate and manage the impacts they create or have created in a way that aligns with the IWA framework.

Remaining Points of Discussion in the Current Situation

While various methodologies exist, if impact accounting is considered as a form of “accounting” akin to existing financial accounting, it’s important to address the following points before proceeding. (Please note that this section is subject to periodic updates through discussions within the global community and impactlake stakeholders.)

- Determining the Use of Wholesale Price-Based or Market Price-Based Approaches: Deciding whether to use wholesale price-based or market price-based approaches in impact accounting.

- Inclusion of Indirect Effects: Defining the extent to which indirect effects, or ripple effects, should be included in impact accounting.

- Handling Volatility in Impact: Addressing potential volatility in impacts, especially for items where impacts may vary significantly in the future, such as research and development or investments.

- Accounting for Long-Term Impacts: Handling items with long-term impacts, which might be realized in the future, such as education and life expectancy.

- Accounting for Continual Impacts: Managing items with impacts that occur over an extended period and addressing the considerations of diminishing returns, including factors like market average improvements or performance deterioration.